AI-assisted banking verification to reduce failed direct deposits

Overview

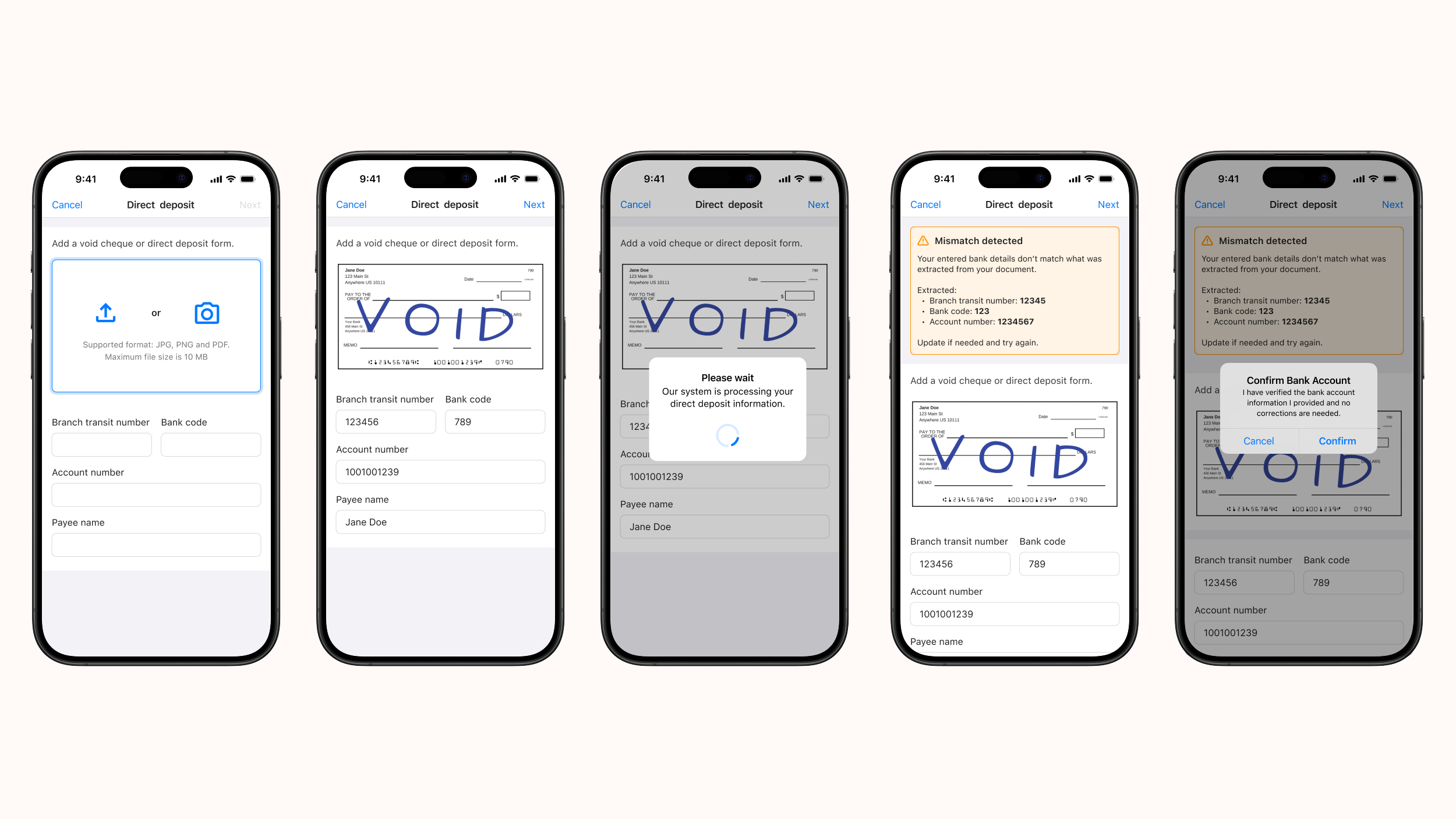

By introducing an AI-assisted verification step to direct deposit setup, members are now required to upload a void cheque or bank deposit form — allowing the system to verify that the banking information entered matches the uploaded document.

This reduced errors at the source, preventing failed reimbursements before claims ever reached adjudicators.

My role: Led the design of a new AI-assisted verification flow for direct deposit setup within a claims submission app, responsible for all flows from ideation to final developer-ready designs.

Problem: The existing experience required manual banking entry with no validation — leading to frequent errors, failed deposits and increased support needs.

Team: Senior UX designer, product manager, business analyst, director of engineering, developers and QA

Understanding the problem

User group: Members (employees enrolled in their company’s health benefits plan who use the application to review coverage and submit health claims.)

Methods: Indirect user feedback from the product manager and exploration of current workflow.

The previous experience required manual banking entry with no validation. Errors were common, especially with long account numbers and inconsistent formats across financial institutions. Failed deposits created delays, frustration and significant support overhead.

Introducing AI-assisted verification offered an opportunity to reduce errors—but also introduced new UX challenges, including varying document quality, AI misreads and the need for clear actionable feedback.

Defining key design goals

With the defined challenges in mind, I established the following high-level goals:

Improve banking information entry accuracy to reduce failed deposits

Present AI findings clearly, with helpful warnings

Support edge cases gracefully through fallback and override paths

Ensure visual consistency across web and mobile

Ideation & exploration

Methods: Competitive analysis of direct deposit setup flows in the market.

I created several flow variations that explored:

When AI should run

How verification results should be presented

How override or manual correction paths should work

Iterative design

Method: Internal design reviews with the product manager, business analyst, director of engineering and developers

Approach: high-fidelity mockups → interaction flows → iterative refinements

Through internal reviews with the PM, BA, and developers, we refined the flow to account for key constraints:

Adjusting messaging based on different AI results

Clarifying the mismatch states to avoid user confusion

Ensuring AI delays didn’t block or trap users

Supporting manual continuation if the AI struggled to read the document

Final design solution

I delivered polished, developer-ready designs for all key verification flows, including:

✓ AI-assisted verification: After uploading their document, members see extracted banking details compared with what they entered.

✓ Clear mismatch and warning states: Contextual messaging explains when fields don’t match or when AI confidence is low.

✓ Manual override path: If the AI cannot read the document, members can continue to complete setup without getting stuck.

✓ Cross-platform consistency: Matching flows for web and mobile ensure a unified experience across devices.

Outcome

Since launching , the feature has been well received with no need for revisions. With tens of thousands of members using the claims submission app, the AI-assisted verification step has strengthened banking data accuracy at the source, reducing failed reimbursements and helping insurers more easily confirm direct deposit information.

Reflection

Designing flexible fallback paths and transparent messaging has been essential to ensuring that AI enhances the experience rather than becoming a barrier.